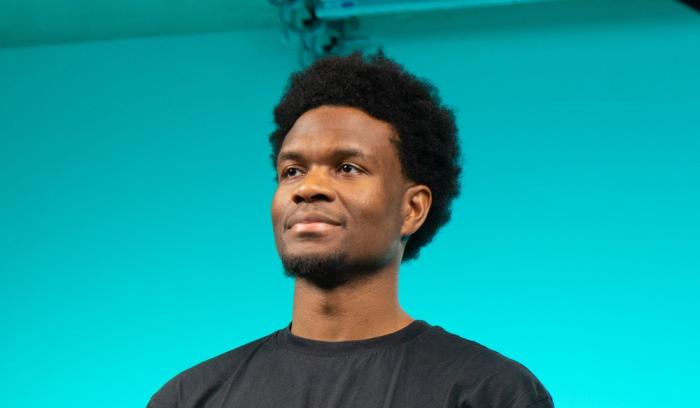

Tips for Money Management from Mr MoneyJar

Rotimi Merriman-Johnson aka Mr MoneyJar is a National Numeracy Ambassador.

He seeks to help people get to grips with all kinds of money matters and understands the crucial role that numeracy has to play.

Here are 6 tips to help you with money management:

Budgeting

It is useful to divide the money you earn into Needs, Wants, and Savings. Needs are the ‘musthaves’ - food, rent, energy bills, council tax. Wants are the ‘would like, but can live without’ items. Savings are what we can keep for later. At the moment, more of our cash is being spent on Needs than ever before, so deal with those first, put your Wants on a wishlist to come back to when possible and save what you can, if you can.

Spending

Once your regular expenses have been paid, there is nothing wrong with spending your money on things you love. For many of us, it’s hard to spend on anything but essentials right now, so plan for future purchases by making a wish list and prioritise your favourites. That way you can start to save up for them when savings are possible.

Saving

Saving is a great habit to get in to, even with small amounts. We’re less likely to overspend if the first thing we do with a pay cheque is put some aside. I recommend working out a manageable amount to save and banking that, before spending the rest.

Emergency Fund

Having an emergency fund can help if you lose your main source of income, or have to make an unexpected purchase. It’s reassuring to know you have some cash set aside. It’s hard to save right now, but if you can, keep a bit of money in a separate and accessible savings account in case something unexpected happens.

Debt

We should never feel pressurised to borrow money if we don’t need it. If we do need it, we should try to borrow only what we can afford to repay and aim to pay it back on time and in full. For anyone struggling with debt, it’s important to get help straight away, and charities like Step Change offer free, independent advice. https://www.stepchange.org/how-we-help/debt-advice.aspx

Confidence

Feeling confident with numbers can help us feel better able to make decisions about money. The National Numeracy Challenge is a great way to boost your number confidence this National Numeracy Day. It’s free and it includes resources to help you manage your money.